How Cursor, Windsurf and Lovable Grow

A deep-dive teardown into the market, product-led growth playbooks, inflection points and the business model (including real P&Ls).

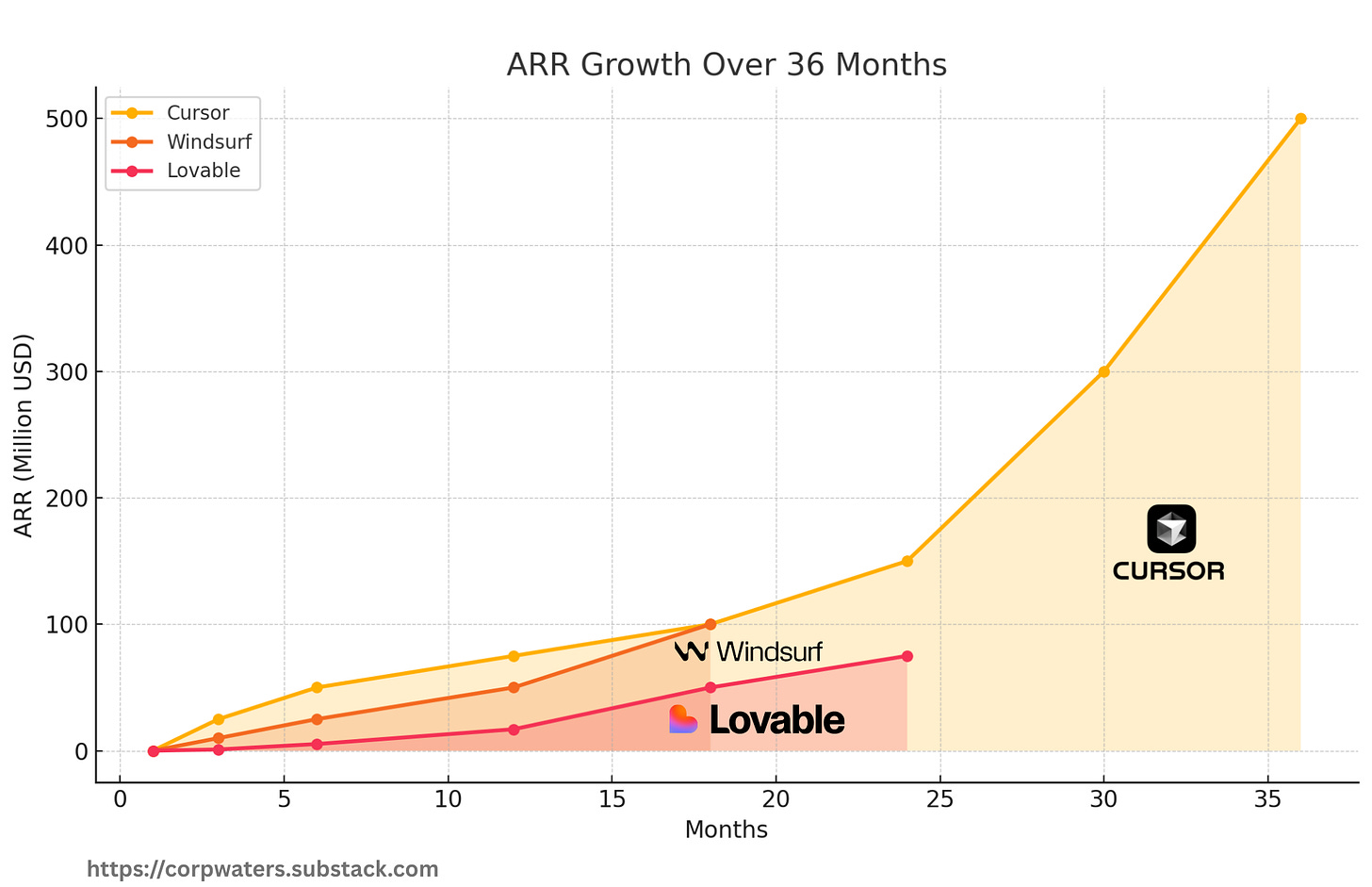

500M ARR in 6 months, 100M ARR in 4 months, 1M ARR in 3 weeks… All those crazy growth numbers have attracted a lot of media attention.

The AI hype-train has ignited the no-code/low-code platform market, sending valuations sky-high.

Cursor is reportedly worth $9.9B, Windsurf nearly sold to OpenAI for $3B before talks collapsed, and Lovable’s latest $150M raise values it at $1.8B valuation.

This is truly unprecedented.

Six decades ago, reaching a $1 billion valuation typically took around 15 years - and only after an IPO.

By the 2020s the average tech start-up needs about six years to reach that bar, while AI-driven companies can do it in just three - all through private funding rather than public markets.

Yes, AI is obviously an accelerator. But as with every new, shiny trend, there’s blind optimism in extreme returns (read as — burning cash).

In this article, I’ll dissect both the market and the core players: how they grow (the full PLG breakdown), what’s their business model and how sustainable it is in the long run.

This is a deeply researched post (40+ sources) and your definitive source on the market and the players.

🧬 Article Structure

The No-Code / Low-Code Market. What’s the TAM and the growth projections up to 2030s.

Key market players. Looking at Cursor, Windsurf and Lovable - evaluation, ARRs, key inflection points.

🔒 How they grow. A deep-dive into each company growth playbooks. Dissecting all the five layers of the product-led growth (Acquisition, Activation, Retention, Pricing and Referrals).

🔒 Business Model. Sizing up their revenues, costs and estimating profitability.

Total words: 3070, reading time: ~25 minutes

1️⃣ No-Code / Low-Code Market

When you think about the NC/LC, it’s useful to draw analogies.

IDE Market

What was the IDE market like in the pre-Cursor era?

Back in the 2000s, it was a niche market valued at < $1 B. Most coding platforms were bundled into the operating systems (Microsoft Visual Studio with Windows, or Xcode with macOS).

With the emergence of mobile and web apps and open-source IDEs, demand spiked, driving the market up to $3.7–5.4 B (~17–20 % CAGR between 2010–2020). Tools like Eclipse and VS Code started becoming more popular.

Now, with AI as an accelerating factor, platforms like Cursor and Windsurf have broken out with a combined valuation of $12.9 B, essentially doubling the market.

This was made possible because of two key factors:

Novel recurrent monetization of software engineers (who are eager to pay the cost for the productivity gains);

Breaking into fringe user segments (vibe coders or non-engineers tinkering around with coding).

Web/App Development

This market isn’t entirely new. Freelance or studio web development was a thing dating to the late 1990s. Back in the day, a single bespoke portfolio web project could easily cost you $5–50 k. Hence, the entire market was lucratively estimated at $10–15 B.

This all changed when companies like Wix (founded in 2006), WordPress (2003), and Weebly (2006) started eating into it. Now you can develop a similar portfolio web project for a fraction of the price and time—about $20—and do so in a few days.

Despite their growth, the whole website-builders market is sized at $2.5–2.8 B, which is at best a 5 % share of the larger pie for app and web development.

Fast-forward to 2025: players like Lovable, Base44 (purchased by Wix for $80 M), and Orchid (recent Y Combinator graduate) come onto the stage. Lovable is already estimated at ~65 % of the entire website-building market.

What all of these platforms are doing is stretching the boundaries of what was once possible and breaking into novel user segments.

If we stretch it to the extreme, any doctor or lawyer could potentially become a software engineer. Instead of hiring a company, they can now build their own appointment-booking systems that are tailored to their needs and have great UX—all without any coding knowledge or even understanding of the underlying concepts.

The barriers to entry for people without expertise have never been so low in history, and this is just a starting point.

The low-code/no-code market is already estimated at $45 B, and some optimistic analysts claim it’s going to grow to $197 B. My personal view is that those numbers are not over-exaggerated.

2️⃣ Key Players

For the purposes of the current analysis, I’ve taken the three core players that have publicly available information on their growth numbers and speculative data on their costs—Cursor, Windsurf, and Lovable.

I’m confident that the number of visible players will increase x10 within the upcoming year, but more on that later.

Crazy ARRs

Cursor hit $500M ARR in 36 months after launch, Windsurf $100M in 18m, Lovable $75M in 24m.

The inflection point for Cursor was at 24 months. They have moved into a larger enterprise segment and doubled their sales headcount (getting from ~8.3m/month to 25m/month revenue). By month 36 the canonical hockey stick curve has kicked in.

For Windsurf the inflection point was at month 12. It was driven by their enterprise sales strategy as well, but with a different twist. They have increased their distribution network via the channel partner program (e.g. AWS Parter Network, Value Added Resellers, Managed Service Providers e.t.c.).

Lovable has invested zero into sales (more on that later) and grew organically. The inflection point for them came around ~12 months after launch and was a combined effect of LLMs getting better at coding (Release of a novel Claude Opus) and their no-cost social media efforts.

I’d speculate that for both Lovable and Windsurf the hockey stick curve is yet to come and we’re to see at least a x10 uptick in growth.