The Ultimate Guide to Flywheels

A flywheel is key to the exponential growth of a business. It informs both the strategy and the tactics. What are the risks of not having it? How to identify a flywheel? How can teams build one?

Hi and welcome to the Corporate Waters weekly newsletter 🙌

I’m Mikhail and I'm excited to share my learnings to help you navigate the complex waters of product management, leadership, and corporate dynamics. Subscribe to unlock the full value.

In today’s PAID newsletter:

(Free) Flywheel Basics - What is it? What are the key traits? How is it related to growth loops in your product?

(Free) Side-effects of Not Having a Flywheel for Product Teams;

(Paid) An Actionable Three-Step Approach to Building a Flywheel for Your Business.

Having worked with numerous product teams, I’ve observed a common pattern: an obsession with tactics. Questions like “What’s our North Star metric?”, “Metric tree?” or “How does our conversion funnel look?” dominate discussions. While these are important, they typically overshadow a holistic view of the business.

A common critique is that PM’s are not strategic enough. In responses to it teams can produce a perfectly compliant textbook strategy. However, upon a closer inspection, it can easily turn out to be a “dressed up” tactical plan revolving around the existing backlog.

I’ve often succumbed to the “tactical allure” myself. After all, when you’re faced with the chaos of daily work routines, you start focusing on and solving what’s immediate. Moreover, as a product lead, I’ve frequently imposed that “tactical mindset” onto my teams.

One concept that has really challenged my thinking is the flywheel of growth. It’s so fundamental to the success of the business that I’d put it above strategy. It informs the strategic choices you’re making. After all, you can’t win if you don’t understand your flywheel and how to get it moving. Additionally, you can’t really plan for tactics if your teams are not assigned to the levers that put the flywheel in motion.

Let’s delve deeper into this concept and explore how it can affect your business.

⚙️ What is a flywheel?

The concept was pioneered ages ago by Jim Collins in the well-known book “Good to Great”. Here’s the original definition:

Good to great comes about by a cumulative process - step by step, action by action, decision by decision, turn by turn of the flywheel - that adds up to sustained and spectacular results.

To put it another way, it’s a combination of levers that, when pushed, ignite motion. This motion produces output, which is then reinvested to ignite even faster motion. The end result is compounding growth over time.

That’s an impressive idea, but difficult to put into practice. That is, until you look at the flywheel from the perspective of “growth loops”.

🔁 Growth loops

A growth loop, in essence, is a method where the output is reinvested as input, doubling the impact in geometric progression.

Below is a basic example of a growth loop from a social messenger app (you can replace Telegram/WhatsApp logos with whatever else).

This simple loop is called a “virality loop”. Let’s look at the other types as well.

Organic

Imagine the user creates content (input) and shares it within the social network (action); this in turn attracts new users searching for that type of content (output) (UGC-loop).

Not only does this content attract new users to the platform, but it also creates second-order effect loops. For instance, existing users on LinkedIn might be impressed with the reach of certain posts and be tempted into publishing their own content.

Inorganic

The same method could be applied to inorganic growth as well. A performance marketing manager acquiring users with positive unit economics might reinvest the difference between LTV and CAC into further acquisition. An alternative view on this is referrals.

Ideally, most of your core features should have an in-built growth loop component. However, having well-designed growth loops doesn’t guarantee a sustainable business.

🌀 Flywheel = Multiple growth loops

Once you stack multiple growth loops together, you'll end up with a flywheel.

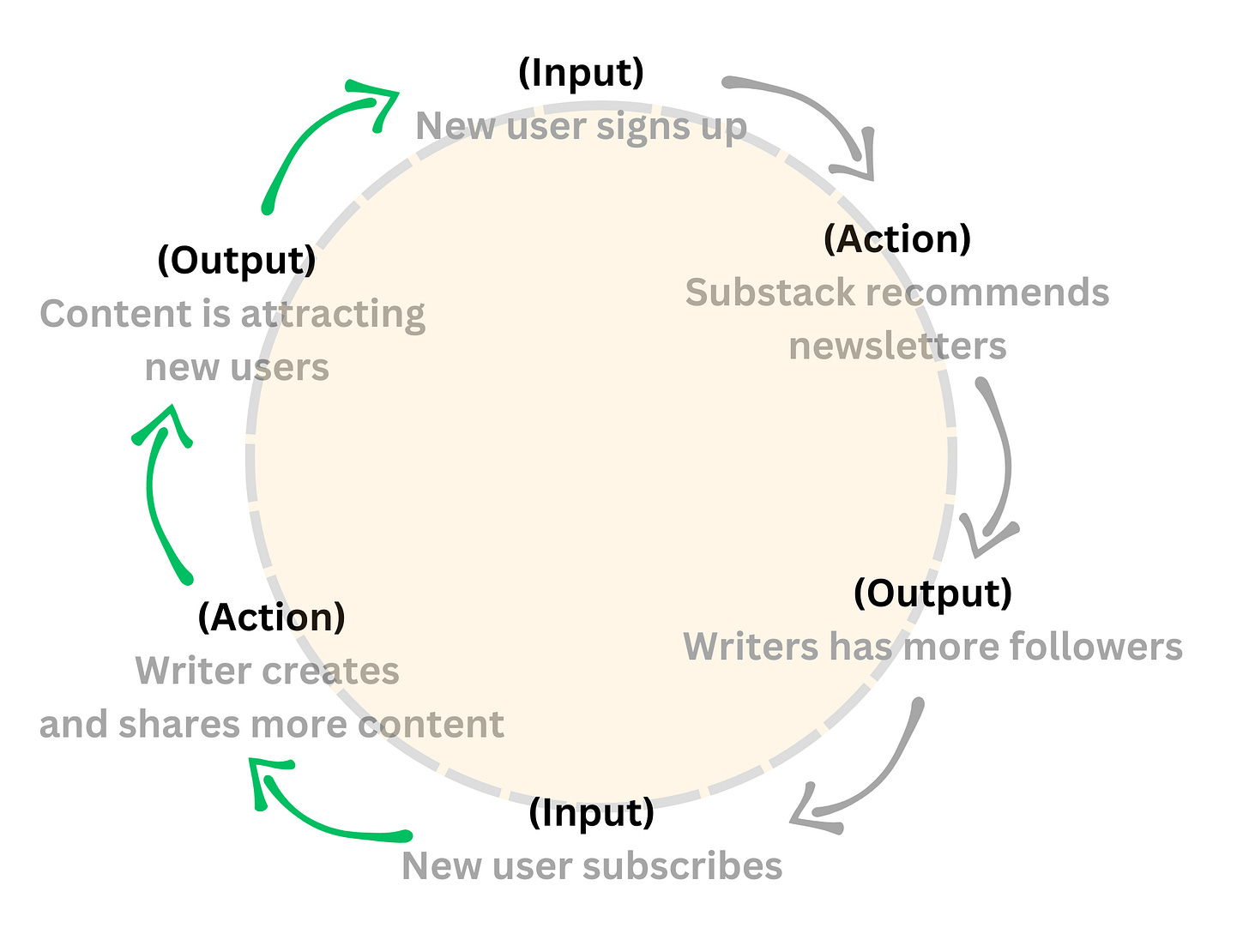

Substack example

First loop is about content exposure. User signs up (input) → the platform recommends relevant content (action) → the writer gets subscribers and views (output).

It might seem like the loop is breaking here as it doesn’t immediately generate new users. What it does, however, is put the second growth loop in motion.

Second loop is around content creation. New users subscribe (input) → the writer creates more content (action) → this content in turn attracts more users - both readers and writers (via social networks, search engines, etc.).

The more content supply the platform has, the more users are eventually drawn to it. Hence, the levers that keep the writers generating more content are the most effective in increasing the value of the business as a whole.

Uber example

A classic flywheel example is Uber’s ride-hailing service (two-sided marketplace).

First loop is about supply. Driver signs up → the more drivers sign up, the lower the pickup times (ETA) and the fares → this leads to more riders on the platform.

Second loops puts demand in motion. Once more riders sign up → the earnings potential for drivers increases → incentivizing more to sign up.

From this perspective, adding supply is the key lever to kickstart the whole flywheel.

Now, since we’ve looked at a few examples, let's delve a little deeper and dive into the key traits of flywheels.

✨ Key traits of a Flywheel

Linear vs. exponential growth

As inputs are constantly reinvested into outputs, the flywheel creates a compounding growth effect over time.

Let's look at a few archetypal examples - Amazon and Alphabet (Google).

If we look at any unicorn’s revenue growth rates, they will show almost identical exponential growth trends.

Evolutionary vs. revolutionary

The compounding effect doesn’t happen overnight. It’s a slow process of flywheel rotation that eventually builds up strong moats (typically ~7-10 years). Over time, strong moats start paying for themselves.

Any revolutionary change (reorg, M&A, etc.) temporarily slows down the flywheel.

Slow feedback cycles

Flywheel rotation effects are not seen on the short-term horizon (<=1 year) and typically become evident on the horizon of ~3+ years.

The only way to trace the effect of changes is by breaking down the flywheel into more sensitive growth loops and treating them as proxies. A product might have dozens of growth loops that are measured on a regular basis.

🚫 Side-effects of not having a flywheel

❌ Local optimization over global maximum

Without clarity on the flywheel, product teams tend to fall for what’s immediate and urgent. Typically, they default to local optimizations within their scope of influence that yield limited outcomes.

At the end of the day, this busywork really doesn’t matter if your business stagnates or grows at limited linear pace.

❌ Optimize for short-term vs. long-term

There are many ways how focusing on the short-term can hinder long-term business impact. One great example is the profitability target, recently spearheaded by many corporations in tech.

Targeting profitability without a clear understanding of the flywheel can easily cap business growth. Typically in such instances, companies start increasing prices, leading price-sensitive buyers to churn, reducing the word of mouth effect, and leading to lower buyer acquisition. Unwillingly, companies might be creating an anti-flywheel with negative long-term implications.

A more sensible approach, taken by “flywheel aware” companies (e.g., Amazon, Meta, Alphabet), was cost-cutting. Yes, it led to 60k+ people losing their jobs only in 2023, but it didn’t greatly affect the flywheel motion of the business.

❌ Feature level thinking instead of business ownership

Problem → Solution mindset creates a very fragmented perception of the business. At any single point in time, there are thousands of problems to solve, from funnels to ops efficiency. On top of it, we always have a limited understanding of the spectrum and the scope of existing problems. All product prioritization is by default biased with limited knowledge.

Teams that are not aware of their business flywheel are constantly fighting an uphill battle against a never-ending stream of local problems. Awareness of the flywheel allows the team to abstract themselves from the backlog and reevaluate how what they are doing moves the needle for the business.

❌ Stakeholder-led decision making

If product teams are not aware of or ignore the business flywheel, they eventually shrink to backlog optimization. This means giving full autonomy to stakeholders (ops/marketing/sales, etc.) to lead and drive the business strategy.

This further reinforces the “backlog operator” position of a PM since the business context is defined above. In a way, it’s an anti product-led flywheel that gets set in motion.

Healthy conflict and pressure with stakeholders is not only important for PMs, but valuable for the growth of the business.

❌ Analysis paralysis

Some teams strive to model the longer-term ROI of their business by making a bunch of assumptions: user price sensitivity, demand acquisition trends, churn dynamics, etc.

Most of the attempts that I’ve seen were exercises in analysis paralysis. Each metric can be predicted with limited accuracy (since it’s based on historical data) and external trends might dramatically impact the forecast. The further we go into the future, the lower the accuracy. At a certain moment, we’re just multiplying noise.

With well-defined growth flywheels, you don’t need to go down that fruitless path. The flywheel motion will eventually yield the compounding returns.