What I learned about Marketplace growth

Lessons from Bolt that are largely applicable to any marketplace.

Hi and welcome to the Corporate Waters weekly newsletter 🙌

I’m Mikhail and I'm excited to share my learnings to help you navigate the complex waters of product management, leadership, and corporate dynamics. Subscribe to unlock the full value

In today’s PAID newsletter:

Marketplace lifecycle stages;

Economics of marketplaces;

How to transition between stages (from the cold start to dominance) while keeping the incentives spend at bay.

Marketplaces are fun. Basics seem deceptively intuitive and straightforward, but once you dig deeper the complexity spikes.

There were plenty of articles and good books on the topic. To name a few, Andrew Chen wrote a solid book (Cold Start Problem), Lenny Rachitsky dived deep on marketplaces in a series of articles and podcasts, NFX team wrote an insane manual on network effects. Why write another one?

Well, this abundance of materials gives a good theoretical foundation on the topic. However, I found it darn hard to apply any of those learnings to practice. They were just missing the hard bit. How much supply do you actually need to drive demand? How do you estimate the incentives? Should you incentivize supply, demand, or both?

The purpose of this article is to give you a no-BS practical understanding of how to manage the growth of marketplaces and transition between stages. No fluff or high-level Twitter quotes.

Let’s dive in.

📚 Setting up the definitions

Marketplace is a business that connects multiple sides (two-three), adding value to all by solving the market inefficiency problem and earning money on it. For instance, in Ridehailing it’s about connecting riders with drivers (two-sided marketplace) and getting a cut. In Food delivery, it’s about connecting a restaurant, a courier and a buyer (three-sided marketplace) while earning a similar cut.

Liquidity ability to match demand and supply. The higher the liquidity, the more matches happen in a marketplace.

Efficiency is measured as supply/demand ratio. The higher the supply, the more revenue a marketplace can generate while reducing revenue per supply item (e.g. vehicle). The lower the supply, the less revenue a marketplace generates in total while increasing the revenue per a single supply item.

Density the amount of demand or supply needed to establish the efficiency

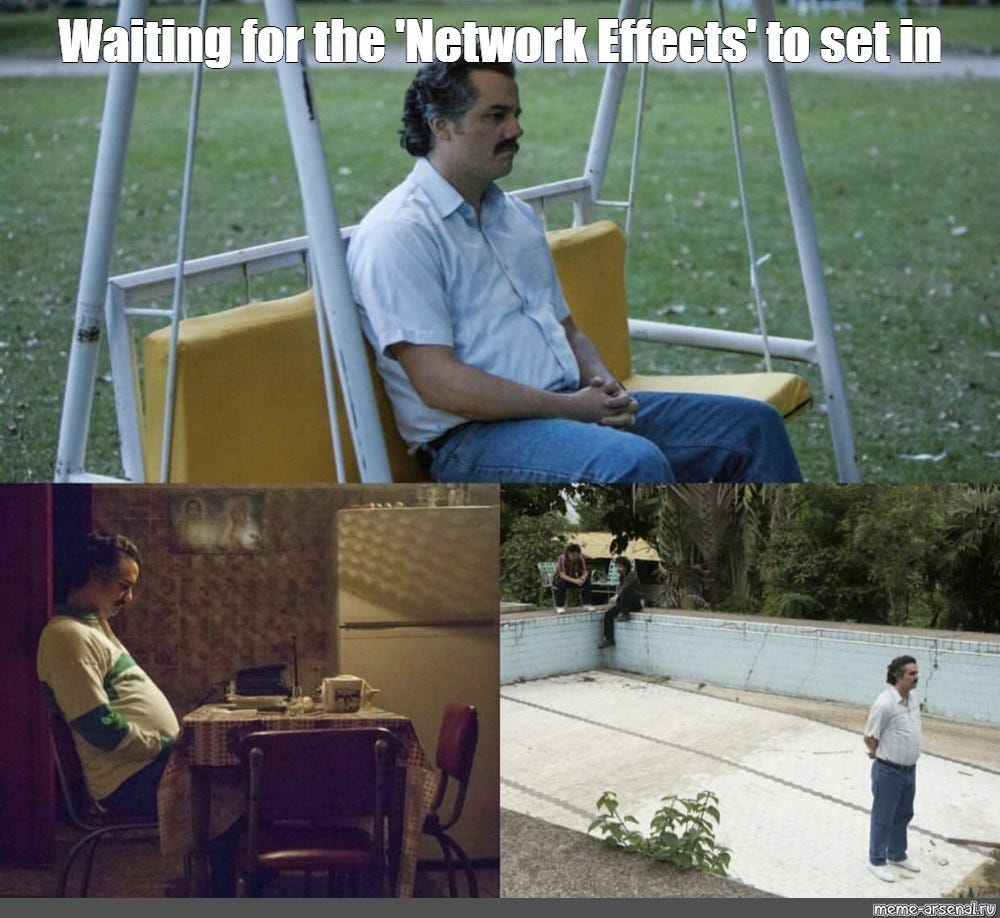

Network effects the bigger the demand/supply density, the more value each new user gets. Since there’s more supply, the car arrival times (ETAs) are lower, the prices are cheaper leading to a better value proposition every single time a new user joins.

The more links the marketplace network has, the more defensible it becomes as it’s harder to copy for new entrants.