What the heck #2

Your bi-weekly shot of product and business news. Bite-sized for people on the go with enlightening commentary.

📈 OnlyFans Profitability

Recently, the UK parent company of OnlyFans, called Fenix International, filed a strategic report for the end of the fiscal year 2022. The company made 5.6Bn in gross payments (+17% from 2021). Revenue ramped up to $1.1B (showing a similar +17% growth). Profits grew from $433M to $525M (+21% growth). The owner issued himself a lavish dividend of €338M.

This growth was driven by the increase in creators on the platform (+47%) and fans (+27%). The supply/demand ratio is 1:100. Essentially, 3.2M creators drive 238.8M viewers to the platform.

💡Curiously, that's how little supply you need to get the marketplace flywheel going.

💰 NVIDIA cashes-in on the AI wave

NVIDIA is now valued at a mind-boggling €1.2T (x4 growth in 12 months). This makes it one of the largest modern-day companies. With AI startups popping up almost weekly, the demand for GPU chips is at its all-time high.

💡 Their secret sauce is making the right strategic choices at the right time. Just five years ago, they were riding the crypto wave and bumped their valuation to 750B. Before that, it was cloud computing and competition with Azure/AWS (and a 10B valuation). Approx. 20 years ago, they were entering the 3D modeling market and grew to 2.5B. But it all started with GPU chips and the gaming industry.

Thinking about it, behind the scenes, there was probably heavy experimentation and failures unseen by the public observer.

🔊 Clubhouse struggling to become relevant again

Back in the covid days, Clubhouse was atop the game - reaching 14.2M installs and a €4B valuation. People were going crazy about live audio chats. I remember facilitating a tech clubhouse meetup back in 2020, which attracted ~300 engaged people out of thin air.

However, the value of the service dwindled alongside the lockdown. Over the past two years, Clubhouse has laid off at least half of their staff and struggled to be relevant. The company became a victim of its own hypergrowth.

Recently, they've announced a shift towards a social network with friends (instead of random followers) that is based around voice chats. Frankly, as with every social network, the graph of connections between people is what gets the flywheel going. Why would users switch from existing social services (e.g., Messenger, Telegram, and even Whatsapp) and suffer the cognitive entry barriers remains a mystery to me. The company will have to rely on their power users, but there's limited growth potential. Hence, I'm very skeptical this is going to fly.

💡 Lesson - if you hit viral growth and a valuation of 1B in a year, sell. Hypergrowth will always cast a shadow on your future prospects.

💹 Salesforce hitting a profitable Q2

Salesforce has been on a spree of M&As (Tableau, Slack, and MuleSoft for a total of ~€50B) and overhiring in the covid days (the number of employees increased by 30% between 2020 and 2022).

Now they've made an expected shift towards profitability in a classic way: efficiency and cost-cutting. They have disbanded their M&M team and laid off 10% of staff. This paid dividends with an 11% year-over-year growth in revenues and net income hitting €1.27B (from €68M a year ago).

Despite pursuing an old-school strategy, I'd say moving a ship as large as Salesforce towards profitability in one year is already an achievement. How sustainable it will be still remains a question.

📉 Babylong Health going down

Babylon Health, a London-based telehealth startup once valued at nearly $2 billion, has declared bankruptcy after facing operational challenges and losing major contracts. A significant portion of its assets was sold to eMed Healthcare UK, while concerns about its patient safety and corporate governance practices had previously been raised.

This raises questions about the future of the telemedicine as an industry.

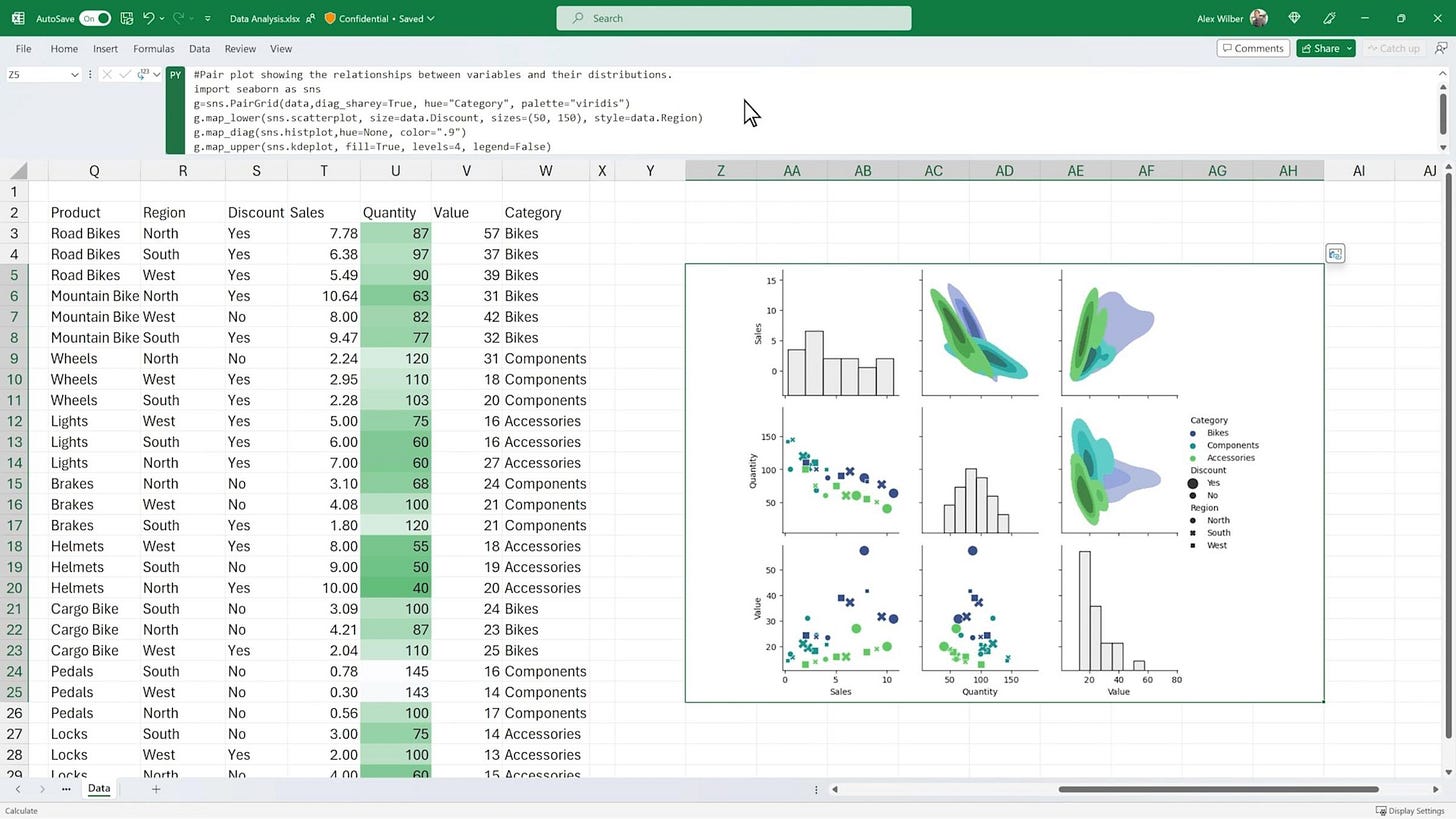

🐍+📊 Excel would get a Python upgrade

For about two weeks, Excel users have gotten access to Python tooling within the familiar sheet environment (as a built-in PowerQuery extension). Not amazing in terms of large dataset analysis (Excel is still limited to 65k rows), but now it's possible to generate fancy complex charts and plots.

Fun, but the added value is questionable. Why not use Jupyter or just a terminal query?