Corporate Waters in 2023

I've been running a Substack business for close to a year. How much I've spent, how much I've earned, key lessons learned. Strategy for 2024.

Hi and welcome to the Corporate Waters weekly newsletter 🙌

I’m Mikhail and I'm excited to share my learnings to help you navigate the complex waters of product management, leadership, and corporate dynamics. Subscribe to unlock the full value.

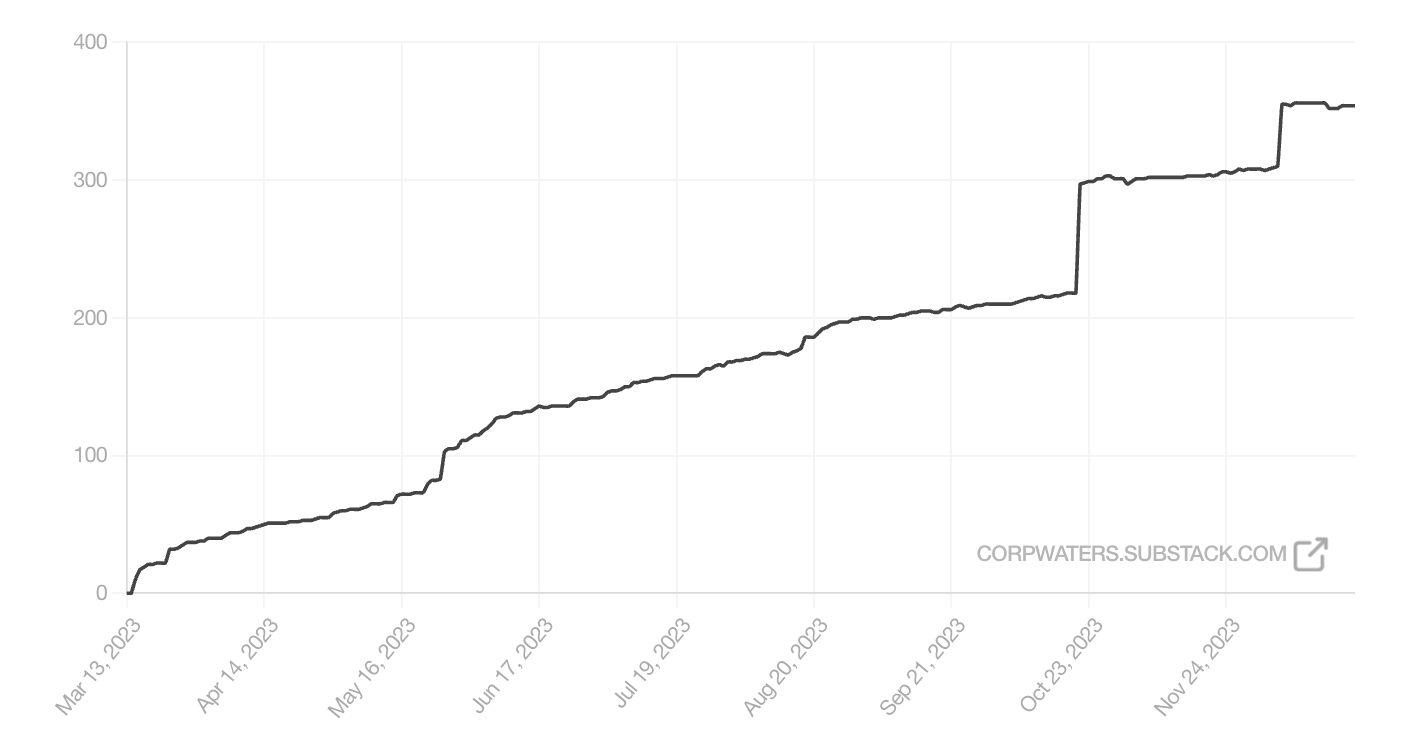

I started writing a Substack blog on the 15th of Mar 2023 and have been doing so until today, which makes it 9+ months so far.

Since the moment I made a commitment to myself and my audience, I’ve published 47 articles. With A4 and single line spacing, that would be equal to 611 pages (my average article length is ~13 pages). That makes it worth two dense non-fiction books about management.

But output is not equal to outcomes; let’s dive into the actual numbers

💸 How much I’ve spent

I spend ~6 hours on average on research, writing, and editing an article. Given my full-time job, I had to allocate Sundays for Substack, effectively adding an extra workday to my schedule.

In addition to writing, I’ve promoted my articles on social networks, within PM communities, and spoke at three conferences (in Estonia, Moldova, and Azerbaijan).

In total, I estimate it to be around ~446 hours, with writing and conferences as the primary contributors.

If you take the average pay of a GPM in Tallinn (source), then the total cost of the whole endeavor would be €6875. The annualized cost of running this Substack enterprise would be €9164.

I haven’t invested in any paid acquisition.

💰 How much I’ve earned

To date, I have 356 subscribers from 44 countries.

The number of paid subscribers at the moment is 30 (fluctuating between 29 and 35).

With my current subscriber base, it’s a ~8% conversion into paid, but I expect it to flatten out with further growth.

My monthly subscription package costs €5 and Substack takes a 20% cut, which makes it a monthly gross of ~€120. The annualized gross projection that Substack calculates is €1920.

📚 Key Learnings

1️⃣ Not breakeven at current scale

My current profit margin is -377%.

For this business to break even, I need to have x4.8 more paid subscribers (~144) and x5.0 more free subscribers (~1800).

Again, this is a simplification as it only considers the current snapshot in time. The costs of running this business might easily grow with the increase in my pay rates.

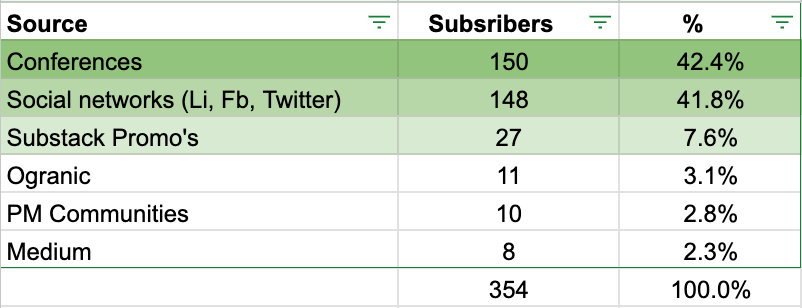

2️⃣ Best sources of acquisition

I must admit I was somewhat lazy in testing user acquisition channels, but here are my key takeaways.

My two biggest acquisition channels are Conferences (42.4%) and Social Networks (41.8%).

Organic growth (through sharing) and Substack promo were meh, bringing only 10.7% of subscribers.

What I’ve found works best is tapping into the existing communities of product managers and increasing your exposure there.

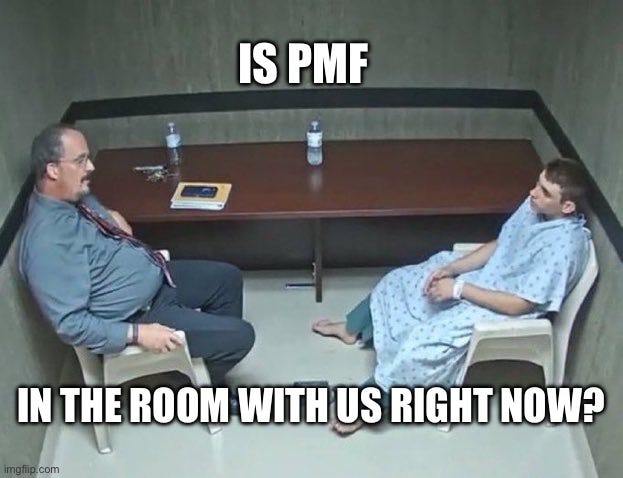

3️⃣ Thoughts on product-market fit

The best definition of product-market fit (PMF) that I've seen comes from Marc Andreessen’s post, dating back to 2007.

You can always feel when product/market fit is not happening. The customers aren't quite getting value out of the product, word of mouth isn't spreading, usage isn't growing that fast, press reviews are kind of ‘blah,’ the sales cycle takes too long, and lots of deals never close.

If I look at my current organic growth, it only delivers 3-10% of the current subscriber base. Most of my subscribers come from “doing things that don’t scale” sources - speaking at conferences and leveraging my social networks.

The key driver for user acquisition is me as a specialist and the perception of my expertise, rather than the content itself.

Coupled with the existing paying user dynamics, I’d interpret this as Weak-PMF (kind of a “blah”).

For comparison, I have 347 subscribers in Medium, 90% of which came organically via a single post written a year ago (>10K views, 1.4k likes, 50+ comments). Hence, it’s the content that should be the primary driver of growth.

4️⃣ Thoughts on 2024

My substack strategy in 2024 would be two-fold:

Increase exposure via new sources;

Tweak the content to drive organic growth.

Increase exposure

Since I haven’t been rigorous in exploring new acquisition channels, in 2024 I plan to double down efforts and test:

Launching a YouTube talking head podcast;

Pitching articles for other product management blogs;

Revisiting my Twitter posting strategy;

Exploring TikTok for promotions.

Etc.

Conferences are great for one-time user grabs, but they are costly and don’t drive much organic growth. In 2024, I’ll reduce my efforts here.

Tweak the content

Subscribers who have shared feedback on the content mentioned that they enjoyed it, but had a hard time catching up. It’s not really a page-turner, but educational material that requires cognitive efforts.

On top of it, it’s read not only by product managers, but by engineers, product designers, data analysts, and curious people from other adjacent fields. I’ve had quite a few complaints from paid subscribers, who dig the blog, but don’t find all the content relevant.

I’m thinking about reaching a broader audience by transitioning into a more generic “business”, “strategy”, and “professional self-development” domains.

Hence in 2024, I plan to experiment with:

Producing shorter, more engaging content;

Exploring non-PM specific content.

🚀 Why Substack blog is still a great investment

Yes, a Substack blog is hard work and it will take some time to get the PMF and organic growth right. At the moment, it’s not break-even and consumes quite a lot of time and mental energy.

Learning

However, I still think it’s a great investment. Here’s why:

I’ve structured my thinking and shaped principles in areas where I previously had only folklore notions (super helpful for my daily work);

I’ve sharpened my writing skills and notice the difference - clarity, brevity, and grammatical correctness have improved.

The Why

Most importantly, I see Substack as a superior long-term strategy over 9-5. Here’s why.

In 9-5, your pay is proportional to the amount of time and skills you invest.

However, your pay is capped with salary bands and market ranges. Typical early merit is 3-5%, which is just a correction for the cost of living. If you decide to change companies, there’s a hard limit to what you can earn on the market. Earnings increase potential is quite limited.

Skills can be replaced. There are always people more competent than you in this world. All of the previous companies I’ve left found a person to fill my position within 3-6 months.

Time is limited. If you invest less, you will reduce your likelihood to be competitive in a given position. However, if you invest more, your pay per hour will go down (as rarely IT pays overtime).

Substack, on the other hand, turns this formula around. Here’s how:

The amount of time you invest (input) is not proportional to the results you’re getting (output);

It’s part of an ecosystem centered around personality, not replaceable skills.

There’s no hard cap to how much you can earn, your addressable niche is the limit.

On top of it, it’s an actual community, which is a low-CAC opportunity for future promos and exploration of adjacent businesses.

The key upside of 9-5 is not pay, but learning. You master corporate dynamics and managerial skills. It’s irreplaceable and my core focus in the mid-term as I learn plenty. Substack for me is a longer-game (~2-3 years) and not an immediate pay-off.

And thank you so much for your work!

I really enjoy your blog!

I guess that it can be incredibly hard to distinguish it from dozens of worthless blogs. A person should attentively read the article and it still may be not enough. After that he must have an experience to understand that what you tell him is something different from staff he can read on a random medium blog.

From my perspective, a good way is to keep going through your personal brand. Maybe you can visit other podcasts as a guest besides of running your own podcast

Good luck!